2025 First Quarter Recap

Catch what you missed and see what’s coming next…

This post is coming from the suggestion of a subscriber.1 To start with, I have plans to share more of my research on industries and some individual companies, with a few investment/business/economic principles sprinkled in. I have subscribers that range from students to investment professionals, so not every post will please every reader. But I write slowly, so I try to make sure that someone will get something, even if it’s just an entertaining discussion.

I have been posting more often since moving to Substack, but not everyone sees every post (even when they want to). What I’m sharing here are links to everything that I’ve published over the past quarter (about once a week), with a few extra comments. I’ll do it every quarter if it’s popular.

I’m not a short-term trader, but the results have been so extreme that they were worth a few comments. My conclusion was quite simple.

What this disruption represents is two different types of opportunities:

A big bet on momentum. High priced stocks grow into their valuation or just keep getting more expensive. Large cap growth continues to outperform.

A bet that the “left behind” stocks catch up to the winners. The market begins to recognize that valuation matters. Small cap value outperforms.

The past few years have been difficult for investors making the second type of bet. Valuation will matter eventually, but it’s hard to predict when that will happen, and a third option is that both value and growth stocks are priced too high.

So far this year, value stocks have outperformed growth stocks, but large cap value has been the best performer. We’ll see what happens over the rest of the year.

This one had another simple conclusion.

[Three] major policies will create another big round of inflation:

Tariffs: Tariffs are effectively a sales tax by another name. Taxing imports will only serve to increase the price of goods, even if production somehow eventually moves to the US (it won’t). We’ve already seen this one before.1

Tax Cuts: The “production” benefits of a tax cut are not as big as advertised, and they are only a short-term benefit. Tax cuts lead to inflation over the long run. We’ve already seen this one too.

Immigration Restrictions: Pulling the cheapest workers out of the system will raise costs and raise prices.

When you combine those policies with the inevitable political pressure on the Federal Reserve (pressure it has been resisting since Nixon), the whole package is an inflationary bomb.

There has not been enough time to evaluate this conclusion (not all of these policies have taken effect yet), but some tariffs have already resulted in dramatic price increases.

Why I Prefer Quality over Quantity (Part 1: Warren Buffett’s Evolution)

Quality, not cheapness, became the new focus.

Why I Prefer Quality over Quantity (Part 2: Defining & Defending Quality)

The short version is that a high-quality company is one that takes care of your investment. When a recession comes, or the stock market crashes, there is comfort in the fact that high-quality businesses will end up better off on the other side. This works on many different levels.

My investment philosophy is clearly inspired by Warren Buffett’s education, but I don’t plan to create a Buffett fan club. My interest is in stealing good ideas from smart people.

Like the video game crash of 1983, customers are rejecting the games that don’t meet their standards. The 2024 version of this problem has two sides: too many “open world” games that are simply too big for players to finish, and a mobile game industry that has no more room to grow.

My perspective on the industry is that Nintendo, with its unique way of avoiding direct competition, has the best position, just like it did 40 years ago. I have a lot to say about video games, so you will see more posts about it in the future.

Stock Buybacks Are Not Always Bad (Part 1: I saw it in a video game)

I can’t remember when I was first introduced to the idea of stock buybacks, but I do remember where I got it from — a computer game series called Railroad Tycoon.

Stock Buybacks Are Not Always Bad (Part 2: When it's bad)

The most outrageous examples of bad stock buybacks are companies that spend everything on buybacks only to beg for a bailout during a crisis. The worst of them come from the 2008 financial crisis, where banks like Lehman Brothers (which failed) and Citigroup (which received $50 billion in bailouts after spending $20 billion in buybacks) engaged in billions of dollars of buybacks right before their own mismanagement put them at risk of failing.

Stock Buybacks Are Not Always Bad (Part 3: When it's good)

The best way to do stock buybacks is to be strategic and intentional. Periodic buybacks, timed when the stock is cheap (and the company has no better alternatives), is the ideal that every manager should reach for.

The thought process behind the decision to buy back shares is more important than the timing. It can be summarized by a simple checklist:

Is the stock cheap?

Are the company’s operations stable?

Is the company’s debt load too big of a burden?

Is there a better investment inside or outside of the company that is relevant to its growth?

The Most Dangerous Investing Shortcut

From my perspective, the most dangerous shortcut is trusting the wrong people to give you the right ideas.

The Four Sources of Investment Ideas

Looking for new investment ideas is such an intuitive part of an experienced investor’s research that it is often an afterthought. But it is a necessary part of the investment process. Even if you’ve been right every time, the curse of “yesterday’s winners” means that what was good in the past might not be appropriate for the future.

Here are my preferred methods, in order of effectiveness:

Reading

Screening

Talking

Watching

All of these methods could be described as “wandering” that is driven by curiosity. And they were borrowed from other investors.

Business as History and Biology

In 2021, I was honored with the opportunity be part of a panel of experts presenting at the ''Real Life and Real Economics'' conference hosted by the European Academy of Sciences of Ukraine (EUASU).

Government research and government risk-taking made it possible and private business made it cheap. They all deserve credit for the parts that they played.

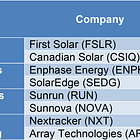

I am always open to exploring what subscribers want to know about. However, if anyone asks about individual stocks, I will usually write about the entire industry unless I really like the company.